Karat

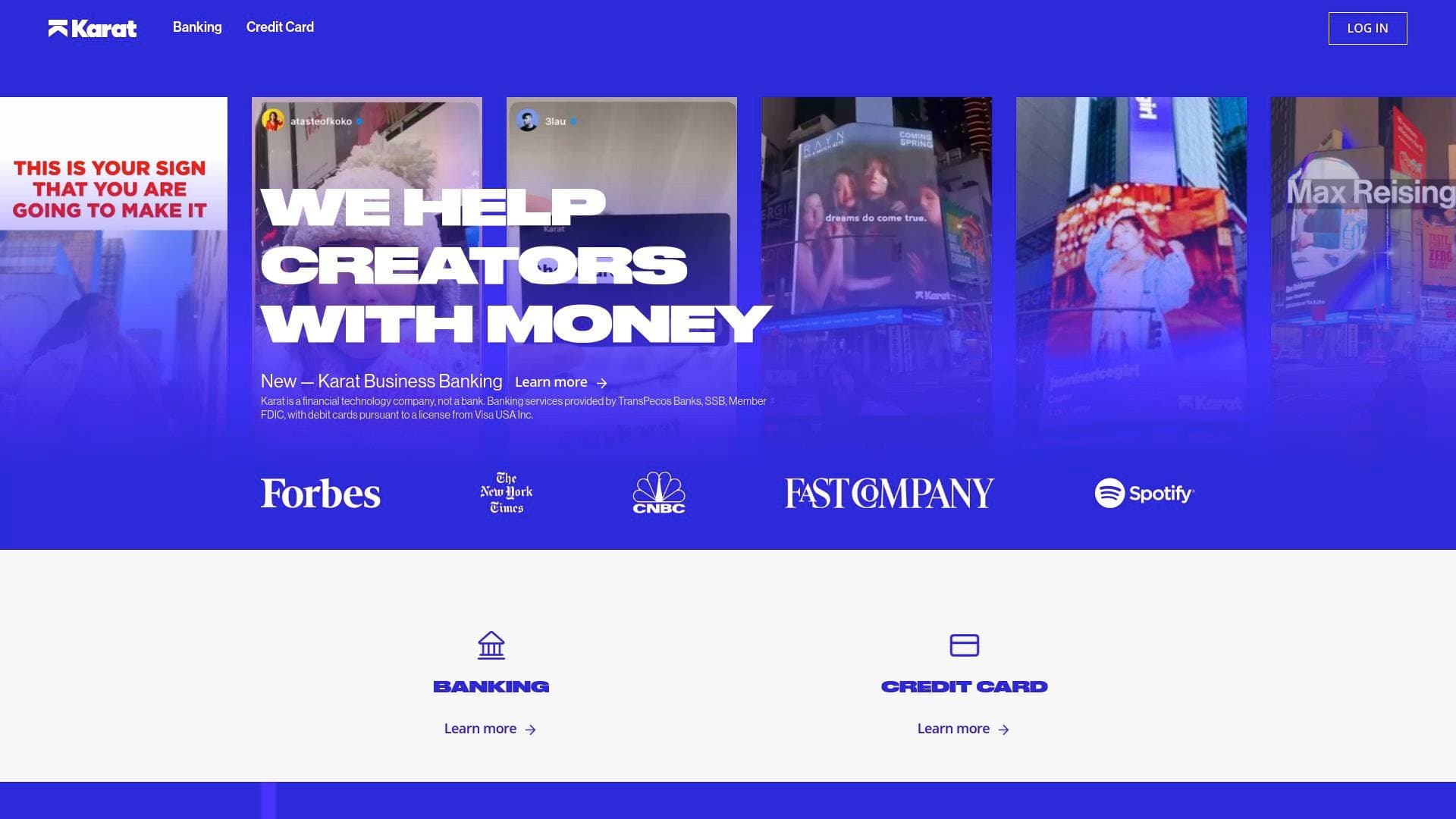

Karat Card is a financial service for creators, offering a business credit card with limits based on social media presence and cash flow, not just traditional metrics.

Brief Overview of Karat Card

The Karat Card is a business credit card and financial service designed specifically for the creator economy. It addresses a common problem faced by influencers, YouTubers, and other digital entrepreneurs: traditional banks often fail to understand their unique business models, leading to rejections or low credit limits. Karat's core approach is to base spending limits on a creator's social statistics and cash flow, providing a more relevant underwriting process. This financial tool helps creators manage their business expenses, invest in growth, and build personal credit history. Beyond the card itself, Karat offers a suite of banking services, including high-yield checking accounts and tools for tax planning, positioning itself as a comprehensive financial partner for modern creative businesses.

Karat Card Key Features for Content Creators

-

Credit Limits Based on Social Stats: Karat evaluates a creator's social media presence and cash flow to determine credit limits. This alternative underwriting model provides creators with the spending power they need to grow their business, even if they don't fit the mold of a traditional small business.

-

Creator-Specific Rewards Program: Cardholders earn 1-3 points for every dollar spent. These points can be redeemed for unique, creator-focused rewards like a billboard in Times Square, custom merchandise, or podcast studio time. Points can also be converted to statement credits at a rate of 100 points to $1.

-

Customizable Rewards Categories: Users can select from a wide range of spending categories to maximize their points earnings. These categories are tailored to creator businesses and include Ad Spend, Camera Equipment, Electronics, Travel, Dining, Subscriptions, and Music Equipment. Categories can be changed every six months by contacting the concierge team.

-

Customized Alloy Metal Card: The physical Karat Card is a durable alloy metal card that can be personalized with a laser-etched version of the creator's logo, adding a professional touch to their business finances.

-

Build Personal Credit History: The Karat Card is designed to help creators build their personal credit score. By making on-time payments on the card balance each month, users build a positive credit history that can assist in qualifying for future loans for apartments, cars, or homes.

-

No Foreign Transaction Fees: Creators who travel for content creation or other business purposes can use the card abroad without incurring any foreign transaction (FX) fees, making international spending more cost-effective.

-

Business Expense Tracking for Tax Savings: The card and its associated dashboard provide a clear view of all business-related spending. This makes it easier for creators to track expenses and maximize their tax write-offs at the end of the year.

-

Concierge Team Support: Cardholders have access to a dedicated Concierge team via live chat for support with their account. This service is available from 9 am to 8 pm ET for assistance with suspicious activity or other questions.

-

Exclusive Community Access: Being a Karat member grants access to an exclusive community and invitations to events featuring some of the world's biggest creators, offering valuable networking opportunities.

-

Integrated Business Banking: Karat also provides business banking services, including FDIC-insured checking and savings accounts. Premium members can earn up to 2.00% APY on checking balances and up to 3.00% APY on dedicated tax savings accounts.

Karat Card Target Users & Use Cases

The Karat Card is built for established content creators, influencers, entrepreneurs, and freelancers who operate within the digital media landscape. The primary users are individuals and small businesses whose income and financial profile are tied to their online presence, making them a poor fit for traditional banking criteria. It is best suited for creators who have a measurable social following and consistent cash flow from their creative endeavors.

Specific use cases for the Karat Card include:

- Scaling Ad Spend: Using the higher credit limits to invest in social media advertising campaigns to grow an audience.

- Upgrading Equipment: Purchasing new cameras, microphones, lighting, or computer hardware to improve production quality.

- Funding Travel for Content: Covering flights, hotels, and other expenses for vlogs, photoshoots, or collaborations in different locations.

- Managing Subscription Costs: Paying for editing software, stock footage sites, scheduling tools, and other recurring business subscriptions.

- Separating Business and Personal Finances: Using the card exclusively for business expenses to simplify accounting and tax preparation.

- Building Credit for Major Purchases: Systematically using and paying off the card to build a strong personal credit score for future mortgages or auto loans.

- Covering Production Costs: Paying for studio rentals, freelance editors, graphic designers, or other production-related services.

- Redeeming Points for Marketing: Using the rewards program to gain unique exposure, such as a billboard advertisement in a major city.

Frequently Asked Questions About Karat Card

How does the rewards program work? You earn 1-3 points on every dollar spent, with the rate depending on custom spending categories you select. Points can be redeemed for unique rewards like billboards and studio time, or for statement credit where 100 points equals $1.

Does the Karat Card have a foreign transaction fee? No, the card does not have any foreign transaction fees. You can use it for purchases abroad without incurring extra charges.

How does Karat help build my personal credit score? The Karat Card helps build your credit history over time. As you pay off your card balance each month, these on-time payments are reported, which contributes to increasing your personal credit score.

How can the Karat Card help me save on taxes? By using the card for all content-related expenses, you can easily track and manage your business write-offs. The dashboard provides a clear overview of your spending, which simplifies the process of maximizing your tax savings.

Do the rewards points expire? No, the rewards points earned with the Karat Card do not expire, so you can save them up for a larger redemption.

How often am I able to change my reward categories? You can change your selected reward categories once every six months. To make a change, you must contact the Karat Concierge team for assistance.

Bottom Line: Should Content Creators Choose Karat Card?

The Karat Card is a highly specialized financial product tailored to the needs of professional content creators. For YouTubers, streamers, influencers, and other digital entrepreneurs who have struggled to get the spending power they need from conventional banks, it presents a compelling solution. Its primary advantage is its unique underwriting process, which values social metrics and creator-specific cash flow, granting access to higher limits that can be used to fuel business growth.

The rewards program is another significant benefit, offering redemptions that are genuinely valuable and exciting for creators, such as Times Square billboards. Features like no foreign transaction fees, personal credit building, and integrated expense tracking for taxes further solidify its value as a comprehensive business tool. While it may not be for brand-new creators without established stats, Karat Card is an excellent choice for established creators looking for a financial partner that understands their industry and supports their ambitions.